south carolina estate tax exemption 2021

I has been a resident of this State for at least one year and has reached the age of sixty-five years on or before December thirty-first. May 2021 House of Delegates Minutes.

The County Assessor however automatically will apply rollback taxes to any property in which the purchaser has not filed an application to continue an agricultural use special assessment ratio property tax exemption.

. South Carolina has a capital gains tax on profits from real estate sales. However you are only taxed. 541 which increased the vermont estate tax exemption to 4250000 in 2020 and 5000000 in 2021 and thereafter.

The South Carolina capital gains rate is 7 of the gain on the money collected at closing. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1206 million in 2022.

If they are married the spouse may be able to leave everything to each other without paying any estate tax. 1 The first fifty one hundred thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment real estate property taxes when the person. A BILL TO AMEND SECTION 12-6-3775 CODE OF LAWS OF SOUTH CAROLINA 1976 RELATING TO INCOME TAX CREDITS SO AS TO PROVIDE FOR AN INCOME TAX.

South Carolina has no estate tax for decedents dying on or after January 1 2005. 12-37-3135 provides that where 1 a property is taxed at 6 assessment ratio prior to a transfer this generally means a second home rental or commercial property. However 44 of the capital gain is exempt.

The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent. Currently south carolina does not impose an estate tax but other states do. 1 The first fifty seventy-five thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment real estate property taxes when the person.

This means that when someone dies and the value of their estate is calculated any. Commercial and residential non-owner-occupied real property - 60. Dependent exemption - as of tax year 2020 4260 can be deducted for each eligible dependent.

I has been a resident of this State for at least one year and has reached the age of sixty-five years on or before December thirty-first. On june 18 2019 vermont enacted h. However South Carolina also has a 44 exclusion from the capital gains flowing from the 1040 federal return effectively reducing the state tax to 392.

There is no exemption for primary residences so any property you sell will cost you 7 on any difference between the price you paid and your selling price. Pursuant to Section 12 -37-220b a manufacturing property tax exemption will be phased in equally over 6 years which will effectively reduce the manufacturing property assessment ratio to 9 by 2023. Currently South Carolina does not impose an estate tax but other states do.

In addition gifts to spouses who are not US. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Inheritance tax from another state Even though South Carolina does not levy an inheritance or estate tax if you inherit an estate from someone living in a state that does impart these taxes you will be responsible for paying them.

The applicable South Carolina county will not prorate rollback taxes between purchasers and sellers. South Carolina Code Section 12-43-220 requires that any time a property changes from receiving the benefit of an agricultural use special assessment ratio property tax exemption to any other use. In 2007 legislation was passed that completely exempts school operating taxes for all owner occupied legal residences that qualify under SC Code of Laws Section 12-43-220 c.

Federal exemption for deaths on or after January 1 2023. Residential real estate owner-occupied - 40. The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. So in reality the actual rate youre paying is just 56 of 7 which is 392. Congress set the estate tax exemption at 5000000 for.

2 where the property remains taxed at 6 ratio after the. In addition there is a federal estate tax imposed on estates in excess of a threshold called an exemption that changes from time to time. Manufacturers participating in a representative organization are.

SC Tax Structure State Deductions and Exemptions South Carolinas other major state deductions contribute to low tax burden June 2021 4 In addition to the standard deduction SC has other deductions and exemptions the largest of which are. South Carolina Code Ann. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

A married couple is exempt from paying estate taxes if they do not have children. South Carolina General Assembly 124th Session 2021-2022 Journal of the House of Representatives. According to the South Carolina Department of Revenue the Homestead Exemption relieves you from taxation on the first 50000 in fair market value of your owned legal residence if you are over the age of 65 or you are totally and permanently disabled or you are legally blind.

South Carolina levies a 7 long-term capital gains tax. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. What are the recent changes to South.

Applications seeking the 6 Exemption are due by January 30 2021 to the Beaufort County Assessor. To qualify for the Homestead Exemption you must meet all of the following criteria. South carolina has no estate tax for decedents dying on or after january 1 2005.

The Key Estate Planning Developments Of 2021 Wealth Management

We Broke Down South Carolina S Education Overhaul Bill Section By Section Palmetto Politics Postandcourier Com

A Guide To South Carolina Inheritance Laws

S C House Leaders Want To Just Tackle Income Tax Cut The Sumter Item

South Carolina Retirement Tax Friendliness Smartasset

Florida Vs South Carolina For Retirement Which Is Better 2020 Aging Greatly

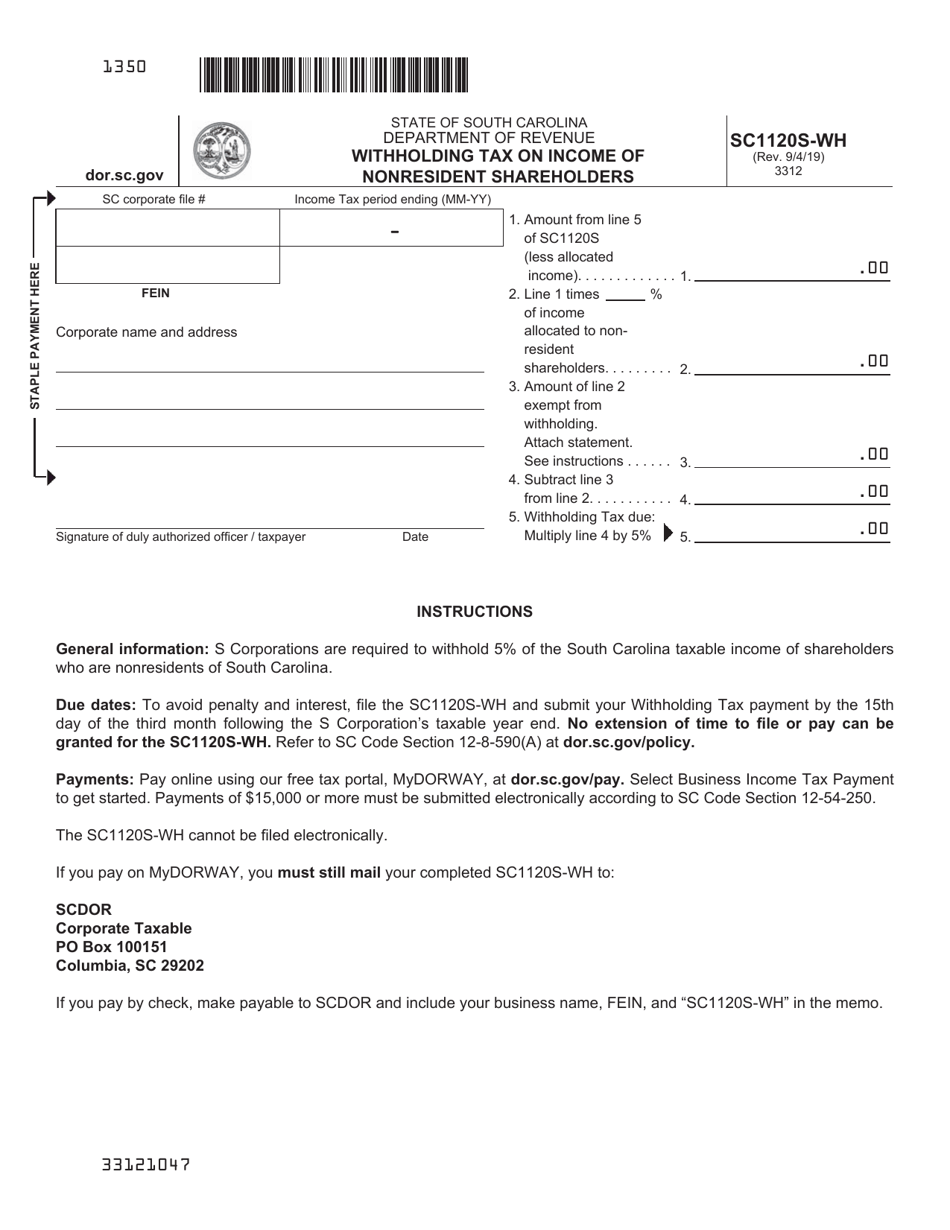

Form Sc1120s Wh Download Printable Pdf Or Fill Online Withholding Tax On Income Of Nonresident Shareholders South Carolina Templateroller

Form St 3 Download Printable Pdf Or Fill Online State Sales And Use Tax Return South Carolina Templateroller

Retirees Moving To These States Can Get Some Great Tax Breaks

Hilton Head Magazines Ch2 Cb2 What You Need To Know About South Carolina Income Taxes

A Guide To South Carolina Inheritance Laws

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

Lawmakers To Consider Tax Exemption Expansions For Military Retirees